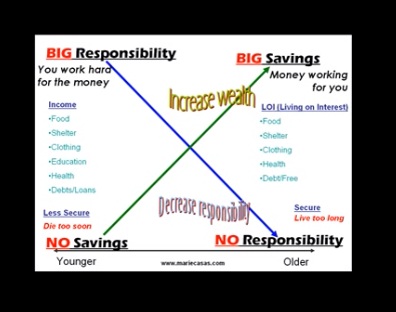

One of the basic and powerful personal finance tool I learned from IMG is the X Curve Concept.

It gives a clear picture of the 2 stages of our Financial life.

Let's start with our younger years.

This is the stage where we are still active and strong enough to work and make money. This is also the stage where responsibilities and expenses are big. This is the point where an active income is a must to provide for our basic needs like food, shelter, clothing, health, education and debts or loans.

Our active income at this point usually comes from our job or businesses. Sadly, our basic needs are permanent while income is not. We still need to eat, change clothes, have a home and of course we need medical attention because as we grow older we are more prone to illness.

It's best to practice our Prosperity formula at this point. This is also the best time to protect ourselves especially if we are the sole breadwinner in the family and many are depending on us.

The question here is: What if we die too soon?

This is the question that shows how you really care for your loved ones. First, you need an Insurance to make sure they have something left when you can no longer provide for them. Next, you need to set up an emergency fund so in situations like loss of job, immediate hospitalization, fire or accidents you still have something to pay for the monthly bills while building your way to recovery.

Now on for Older years.

You may think that the next stage is still far from where you are now. But this stage is where we are all going to. Now what we did or did not do during our younger years will reflect on this stage.

Ideally, there should be less responsibility at this stage, no more debts and loans and at this point we should already be living on interest. No more dragging of ourselves to work and more bonding time with the family. Our money should now be working for us.

Now, provided you have saved enough for your future. The dilemma is What if you live too long?

According to the latest reports, life expectancy is longer now because of advances in medical technologies. You may have saved enough for 10 years after your retirement but is it enough? What if you lived another 10 years? I'm sure you don't want to be passed around by your children when you are already old and sick. By this time they already have a family of their own and on the stage of big responsibility.

At this point you have to be covered enough for your health expenses, emergency fund and long term fund for all other expenses. Ideally at this point, you are already living on interests where your money is working for you.

|

| Photo screenshot from sxyshandy |

It basically shows that we should accumulate and save more while we are young and actively earning money to prepare us for our future. It takes time for money to grow and it is our great ally in securing our future. So better start now.

What's your next action?

1. Like the Pinay Helpdesk page to get bits and pieces of financial tips.

2. Answer this Appointment form if you are interested to attend a financial coaching in person or via online.